One of the most common questions startup founders face is: how much equity should you offer to new hires? Stock options are a key part of compensation in startups, helping to attract top talent and align your team with the company’s long-term goals. But getting it right requires balancing fairness, market standards, and your startup’s growth potential.

Let’s dive into the details of offering stock options and how you can structure them effectively.

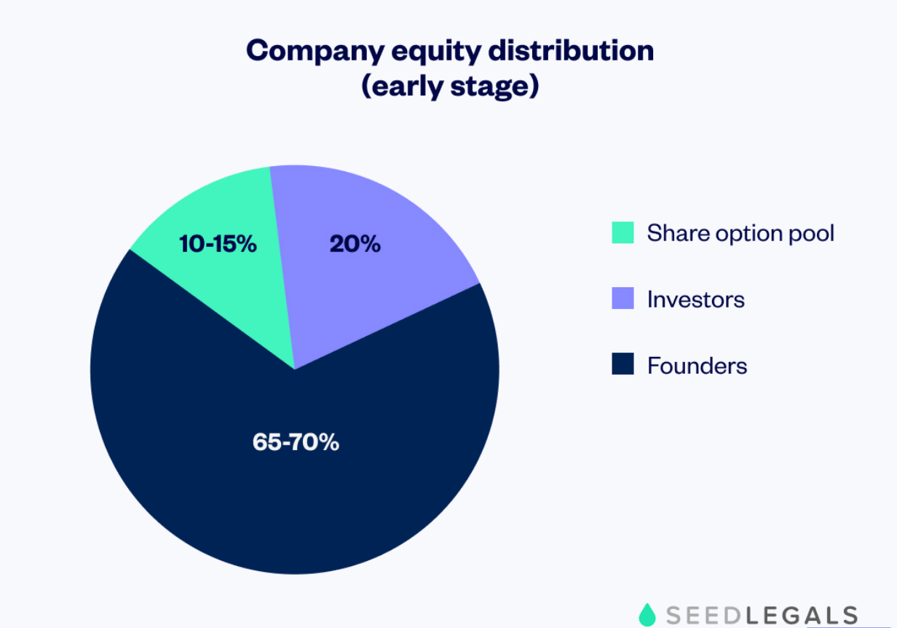

Typical Equity Ranges for Early-Stage Startups

The percentage of equity offered often depends on the role, the stage of the company, and the candidate’s experience. According to data from SeedLegals, here’s what you can expect for early-stage startups (those with up to 50 employees):

-

C-suite: 0.8% - 2.5%

-

VPs: 0.3% - 2%

-

Directors: 0.5% - 1%

-

Managers: 0.2% - 0.7%

-

Other employees: 0% - 0.2%

These ranges provide a starting point but should be tailored to your unique circumstances.

Why Stock Options Matter

Stock options aren’t just about adding another line to the offer letter. They are a powerful tool for:

-

Attracting Top Talent: Startups often can’t compete with big corporations on salary, but equity can make up for that gap by offering long-term upside.

-

Aligning Goals: Options ensure that employees’ success is directly tied to the success of the company.

-

Building a Commitment to Growth: Employees with equity have a stronger incentive to help the company grow and thrive.

Structuring Your Stock Option Offer

To make stock options meaningful and attractive, consider these best practices:

-

Be Transparent: Explain what stock options mean, including vesting schedules, potential dilution, and the company’s growth trajectory.

-

Tailor the Offer: Match the equity package to the seniority and expected impact of the role. For example, a key hire in the C-suite may deserve a larger slice of the pie than a junior role.

-

Balance Cash vs. Equity: While options are attractive, candidates will still need a reasonable base salary to meet their financial needs.

Helpful Resources

Navigating stock options can be complex, but there are excellent resources to help you get it right:

-

Our Startup Recruiting Masterclass Guide – Download it for free here.

These resources provide actionable insights into structuring equity, understanding market standards, and communicating effectively with candidates.

Pro Tips for Equity Discussions

Equity discussions can be a make-or-break moment in hiring negotiations. Here’s how to get them right:

-

Clarify Vesting Schedules: Most startups use a 4-year vesting schedule with a 1-year cliff. Be clear about how this works and why it’s standard.

-

Discuss Potential Upside: Show candidates the potential value of their equity if the company succeeds. Use real-world examples if possible.

-

Address Dilution: Be upfront about how future funding rounds could affect their equity percentage.

Why This Matters

Equity isn’t just compensation; it’s a statement of trust and partnership. Offering the right amount of stock options—and presenting them transparently—can help you attract and retain the best talent while aligning your team with the vision of your startup.

When done right, stock options aren’t just numbers on a page; they’re a reason for your team to believe in your mission and give their best every day.

What’s your approach to offering stock options? Let’s discuss in the comments or reach out if you’re navigating this for the first time!

Discover more from our Hiring Manager's cheat sheet / Glossary here: https://funded.club/glossary

Need Help Hiring After a Funding Round?

Stock options are just one piece of the puzzle. Getting the right people through the door — fast — is what really moves the needle after funding. At Funded.club, we place interview-ready candidates in front of you within 7 days.

See our pricing · Try the Growth Planner · Book a free call

Related reading:

Your First 10 Hires After Funding

Hiring after a funding round?

First candidates in 7 days. Fixed-fee, no commission.